Put yourselves in the shoes of Delhivery. What do you do when quick commerce and hyperlocal deliveries become the norm for most of India’s online shoppers? You move where the customers are going.

And that’s why, this week Delhivery did something that many think was a logical move, just a reaction to how the market is moving.

The listed logistics major entered the on-demand transportation and delivery services for both businesses and consumers with a new app, Delhivery Direct.

Under this, Delhivery will offer pickups within 15-minutes of booking for local deliveries using two-wheelers for parcels as well as three and four wheeler vehicles for larger consignments.

Taking on the likes of Pidge, Porter, Uber, Rapido, Borzo and others, Delhivery is targeting customers in 18,000 postal codes for intercity shipments of small and large parcels

After the Q4 FY25 results, Delhivery MD and CEO Sahil Barua had announced a pilot in Ahmedabad “We are now fully live with Delhivery Direct across NCR and Bengaluru – two of the largest markets for on-demand intracity service in India and will rapidly expand to key metros,” he added this week.

Delhivery is targeting the SME ecosystem, but the app is also available for consumers for personal parcels and not just for business deliveries. This is distinctly different from Delhivery’s previous core B2B2C model. In some ways, Delhivery is playing in a D2C territory that it’s not entirely familiar with.

A New Dawn At DelhiveryComing hot on the heels of its acquisition of Ecom Express for $165 Mn (about INR 1,407 Cr), Delhivery’s new Direct app further thrusts it into the public limelight as now the company would be targeting consumers as well.

Although it was still in its pilot phase in the previous quarter, Barua said the addition of the new vertical brought growth in Delhivery’s partial truck load (PTL) service. Delhivery closed the fiscal year FY25 registering profits in all four quarters. In Q4 FY25, the companyreported a consolidated net profit of INR 72.6 Cr and operating revenue grew 6% to INR 2,191.6 Cr in Q4 FY25 from INR 2,075.5 Cr in the year-ago quarter.

Delhivery’s entry into the hyperlocal logistics market comes at a time when the space is seeing a fresh interest from more logistics players. Although Porter, another incumbent in the space, recently turned into a unicorn early in May, its position has been challenged by players like Uber, Rapido and others in recent times.

Last year, IPO-bound Shiprocket announced the launch of its local deliveries ‘Quick’ offering, a same-day shipping service to enable SMEs across India to get their cargos transported at rates as low as INR 10 per kilometer. Shiprocket is the only platform that operates as an aggregator currently, enabling businesses to select last-mile delivery platforms.

Most recently, ride hailing major Uber announced the expansion of its courier service Uber Courier with thelaunch of Courier XL in India to deliver large goods. In May, the company said that the Courier XL service has been launched in Delhi NCR and Mumbai and shared plans to launch the services in more cities of the country in the coming months.

With ecommerce marketplace volumes hit by hyperlocal and quick commerce growth, Delhivery is moving away from its core business. Some such as Myntra have also expanded and invested in quick commerce, while D2C players are also doing same-day deliveries to enable faster fulfilment and compete with quick commerce marketplaces.

Even when it comes to ecommerce marketplace, the fulfilment models have shifted from large warehouses spread around the country to clusters around major markets. Flipkart’s transition is evidence of the same.

In a note shared this week, Jefferies said that Delhivery’s 41% rally post-Ecom Express deal in April 2025 reflects optimism on industry consolidation. The firm added that Meesho’s shift to its internal logistics platform Valmo could pressure Delhivery’s 3PL Express Parcel (EP) business, which is 60% of its sales.

The Hyperlocal Competition“D2C channel costs are already higher vs marketplaces. Thus, Delhivery may not be able to charge higher prices despite the bargaining power as Merchants may flee to channels with lower total cost to protect profitability,” the brokerage added, pointing to the growth of in-house logistics platforms on the marketplace side.

Besides the traditional players, Delhivery’s business model was being disrupted by the likes of Blitz and Zippee, which were targeting same-day and two-hour deliveries for D2C brands. It makes sense for Delhivery to compete with these players on equal footing and meet its customers (merchants and brands) where they are flocking.

Some of its rivals though have been working on this model for years. Blitz has worked on same-day deliveries for nearly three years, while Zippee also has an headstart on Delhivery. There’s also the matter of thin margins in hyperlocal courier deliveries.

It’s the reason why Uber and Rapido have added courier services as an add-on to the bike fleet. For Delhivery, it will be critical to get to profitable growth within this vertical rapidly. The company could also look at an acquisition in the near future in this space, just like it did with Ecom Express.

While the Ecom Express deal is expected to curb the price wars in the logistics tech space, Delhivery cannot become embroiled in cashburn wars in the hyperlocal space.

And it’s too early to say whether Delhivery’s shift to dark stores and hyperlocal deliveries will pay off. “Fashion, beauty and personal care (BPC), and electronics accounted for 75-80% of B2C shipments in FY24. The SKU shift away from marketplace and D2C brands to quick commerce can impact industry volume growth. Delhivery on its part is launching shared dark stores to address the QC demand, but we do not build this into our estimates given the business is still in its nascent stages,” Jefferies added.

There’s also a threat of the likes of Zomato and Swiggy also leveraging their existing fleet for courier services, which combined with their distribution advantage might blindside existing players. So while Delhivery Direct seems like the right idea for the right time, the key aspect will be a light touch on the accelerator.

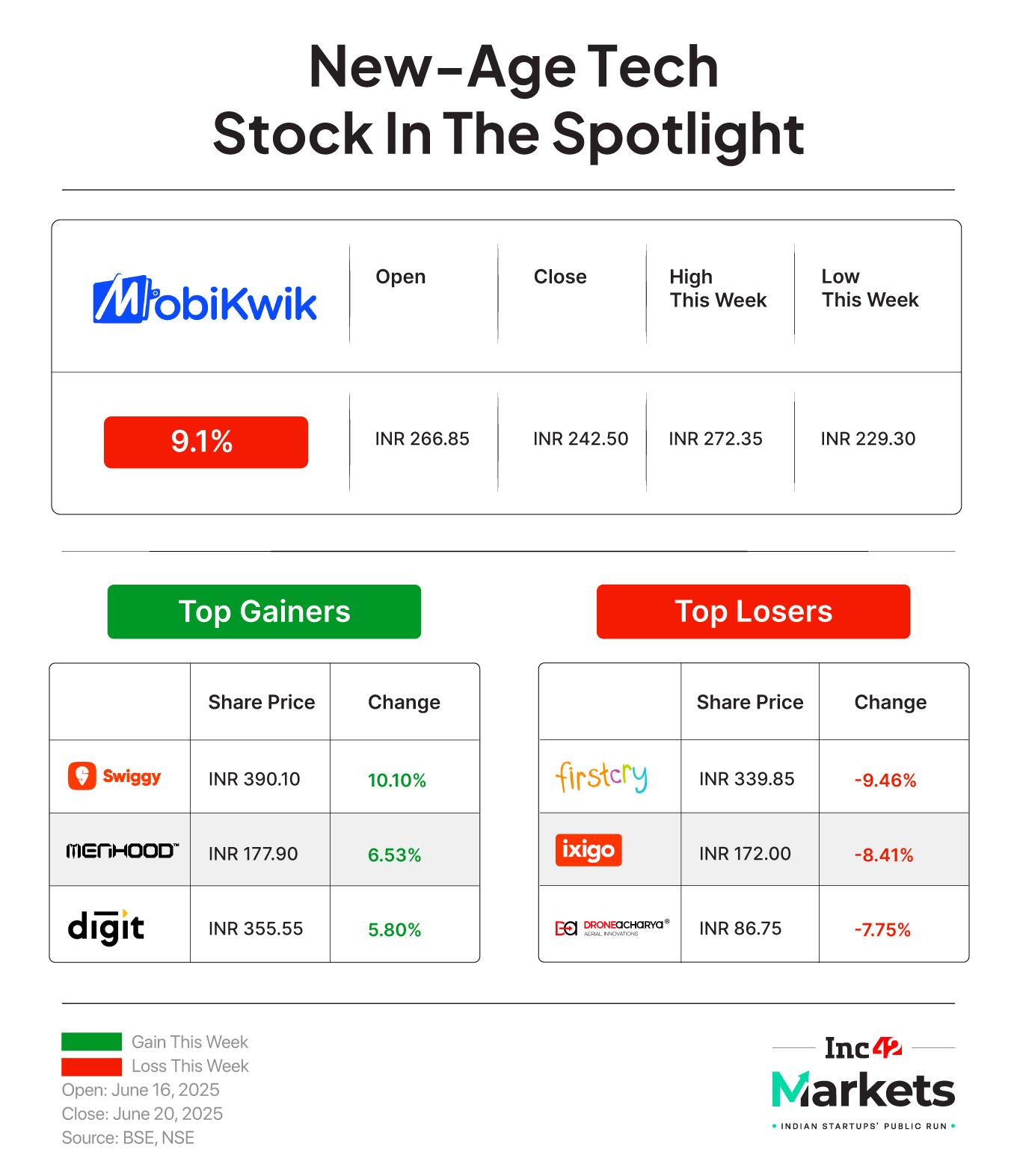

MobiKwik On The RadarMobiKwik shares fell more than 9% in the week as the mandatory six-month lock-in period for pre-IPO shareholders came to an end in the week gone by. Around 3.8 Cr shares are now eligible for trade following the expiry of the lock-in, and the stock ended the week at INR 242.50.

After listing at a 58% premium over its issue price of INR 279, the stock has plummeted well below its listing price now. The end of the lock-in coincides with lingering investor concerns around the company’s financials, and the lack of a credible growth vertical. The company’s net loss ballooned 83x to INR 56 Cr in Q4 FY25.

Now, the next week might see some more gains for MobiKwik as investors add the stock to their pile, however, this is not a guarantee, especially since the investors selling after the lock-in ends would be exiting at a profit so we could see the sell-off continue even if the price hovers at the current levels.

Markets Watch: New Listings, Deals & More

- DroneAcharya’s Results Delayed: BSE SME-listed DroneAcharya has delayed its submission for the second half of the fiscal year FY25 (H2 FY25) by over a month now, deferring it from May 27 to July 11

- ArisInfra’s IPO Closes: The IPO of B2B ecommerce company ArisInfra Solutions closed with an oversubscription of 2.65X, with investors bidding for 3.47 Cr shares as against 1.31 Cr shares on offer

- MMT’s Huge Raise: Days after announcing plans to raise capital via a mix of convertible notes and a primary offering of shares, MakeMyTrip has raised $3.1 Bn to repurchase a portion of its Class B shares from China’s Trip Group

- Capillary Gears Up For IPO: The enterprise tech startup has refiled its DRHP with SEBI for an IPO, which will comprise a fresh issue of INR 430 Cr and an OFS component of 18.3 Mn shares. This comes weeks after the company’s board gave its nod for an INR 2,250 Cr listing

- Paytm’s FEMA Troubles: The listed fintech major has filed a compounding application with the RBI to settle an ongoing case pertaining to alleged forex violations. In March, Paytm received a notice from ED over alleged foreign exchange violations totalling INR 611.17 Cr

The post Delhivery Takes The Hyperlocal Turn appeared first on Inc42 Media.

You may also like

US-Iran tensions spike: Washington issues 'worldwide caution'; Tehran says response to American strikes will be 'proportionate'

'I took my family to UK's dullest region - we'll definitely be back for more'

Peppers will turn out 'delicious' with simple growing method

Aldi announces 30 locations for new stores across UK - full list

Genius packing hack praised as traveller avoids paying £43 for extra luggage