Amid the ongoing food delivery rush, digital fraudsters seem to have found a new way to scam unsuspecting citizens via a fake website by the name ‘Jio Eat’.

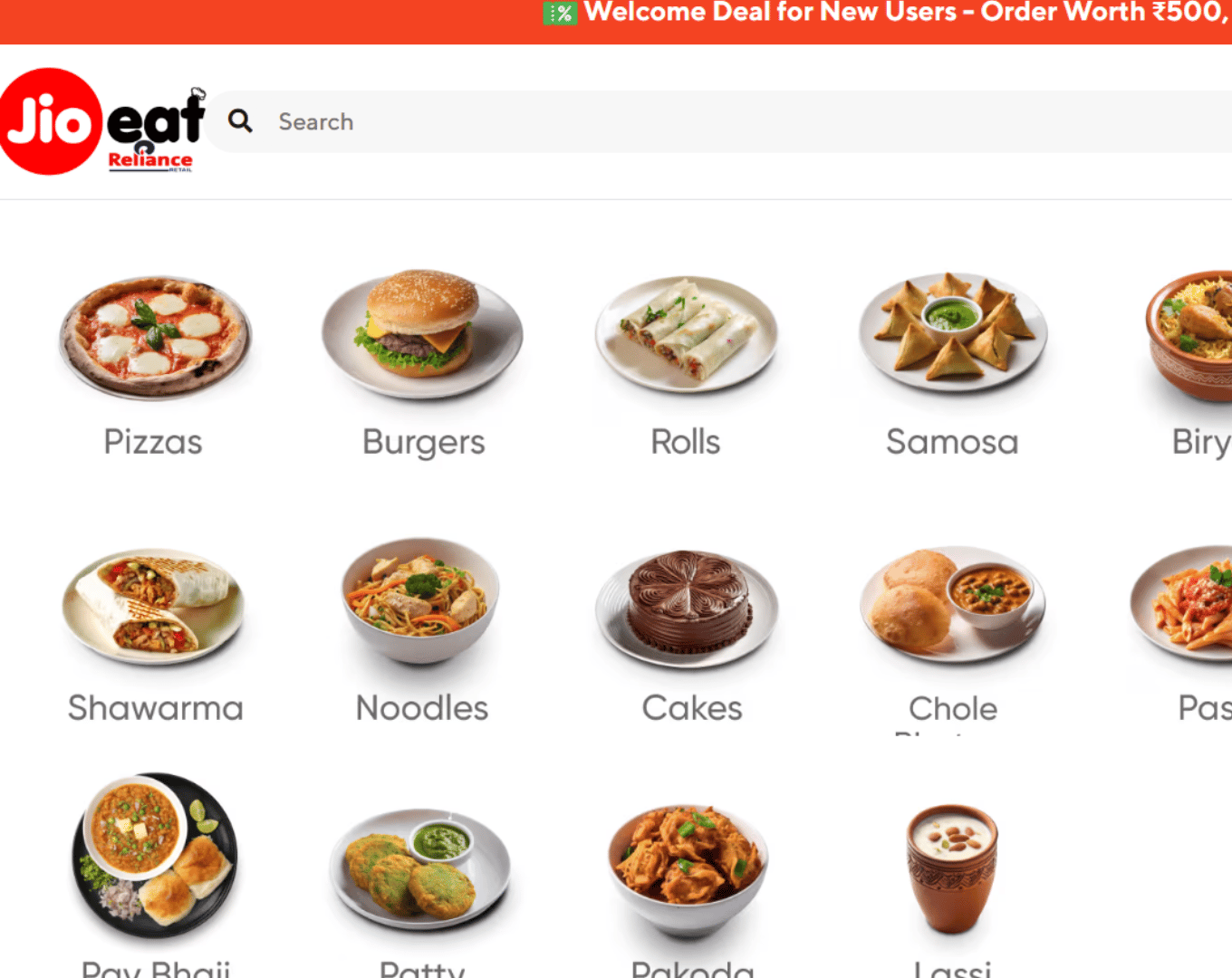

The website, which uses the logo of Reliance Jio and claims to be associated with Reliance Retail, shows food delivery service being live in 15 cities including Bengaluru, Delhi NCR, Mumbai, Hyderabad, Pune, among others. But the reality is something altogether different, as users are scammed out of cash through inflated order value once they place the order.

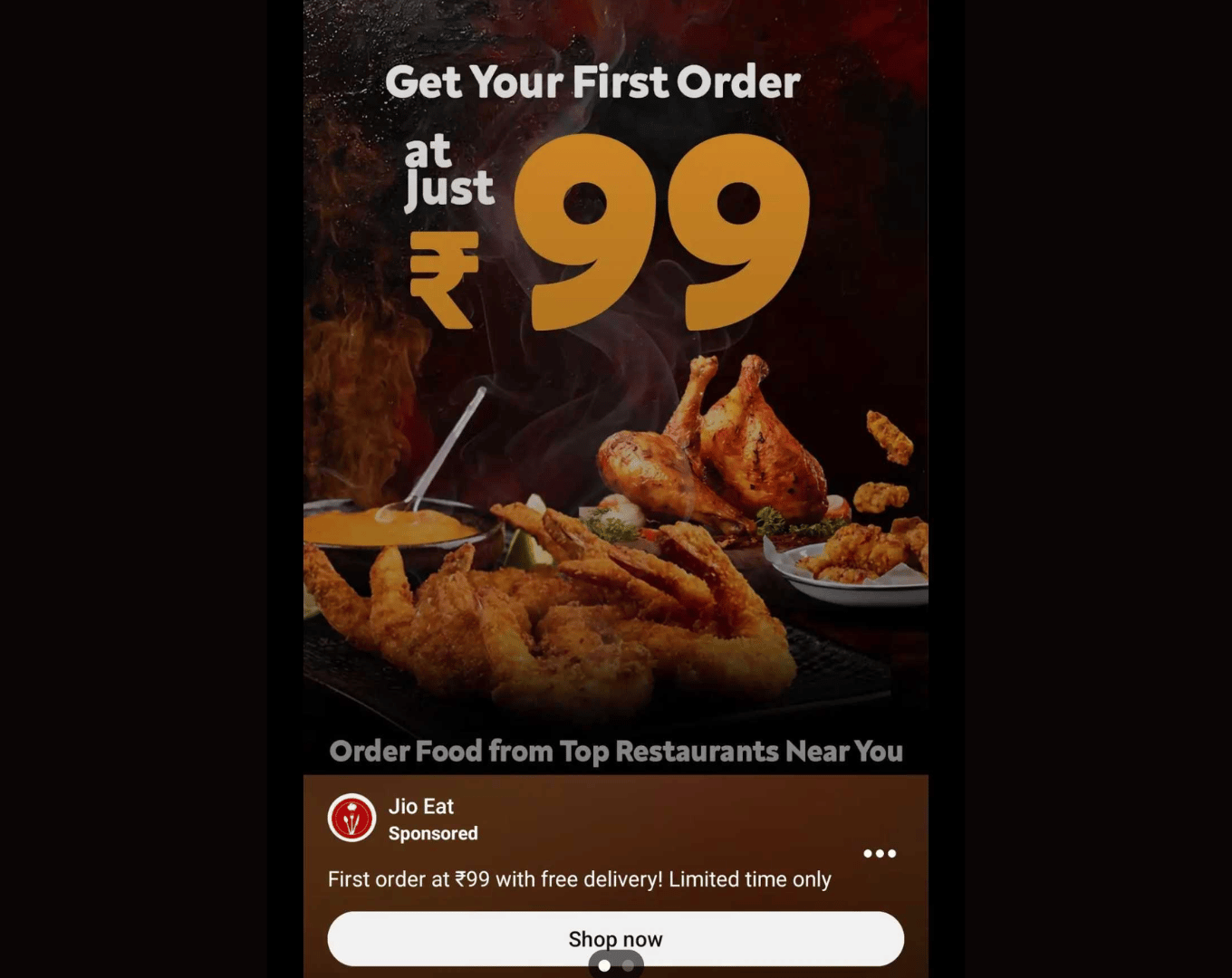

The Jio Eat website is luring users with an offer of ordering any food item of up to INR 500 for INR 99, along with free delivery.

The platform claims to deliver in a radius of 10 km. “We’re operational 24/7—the one and only. Order anytime on Jio Eat with no surcharges or hidden fees,” the website states.

The fake platform claims to deliver food from popular quick service restaurants (QSR) chains like Pizza Hut, Subway, Burger King, Wow! Momo, among others. To make the website look more authentic, it also shows privacy policy, shipping and delivery policy, and terms and conditions.

“Jio Eat Private Limited, having its registered office at 3rd Floor, Court House, Lokmanya Tilak Marg, Dhobi Talao, Mumbai – 400 002, Maharashtra, India (“Jio Eat, “we”, “us” or “our”) operates and manages the mobile application/website and tablet applications available at www.jioeat.in (collectively referred to as the “Jio Eat Platform”, “Website”, “App), which facilitate the order and delivery of food and beverages from various partner restaurants listed on the Platform (“Products”),” the privacy policy reads.

The Modus OperandiWhen a user tries to place an order, the platform only offers an option to pay using a debit/credit card.

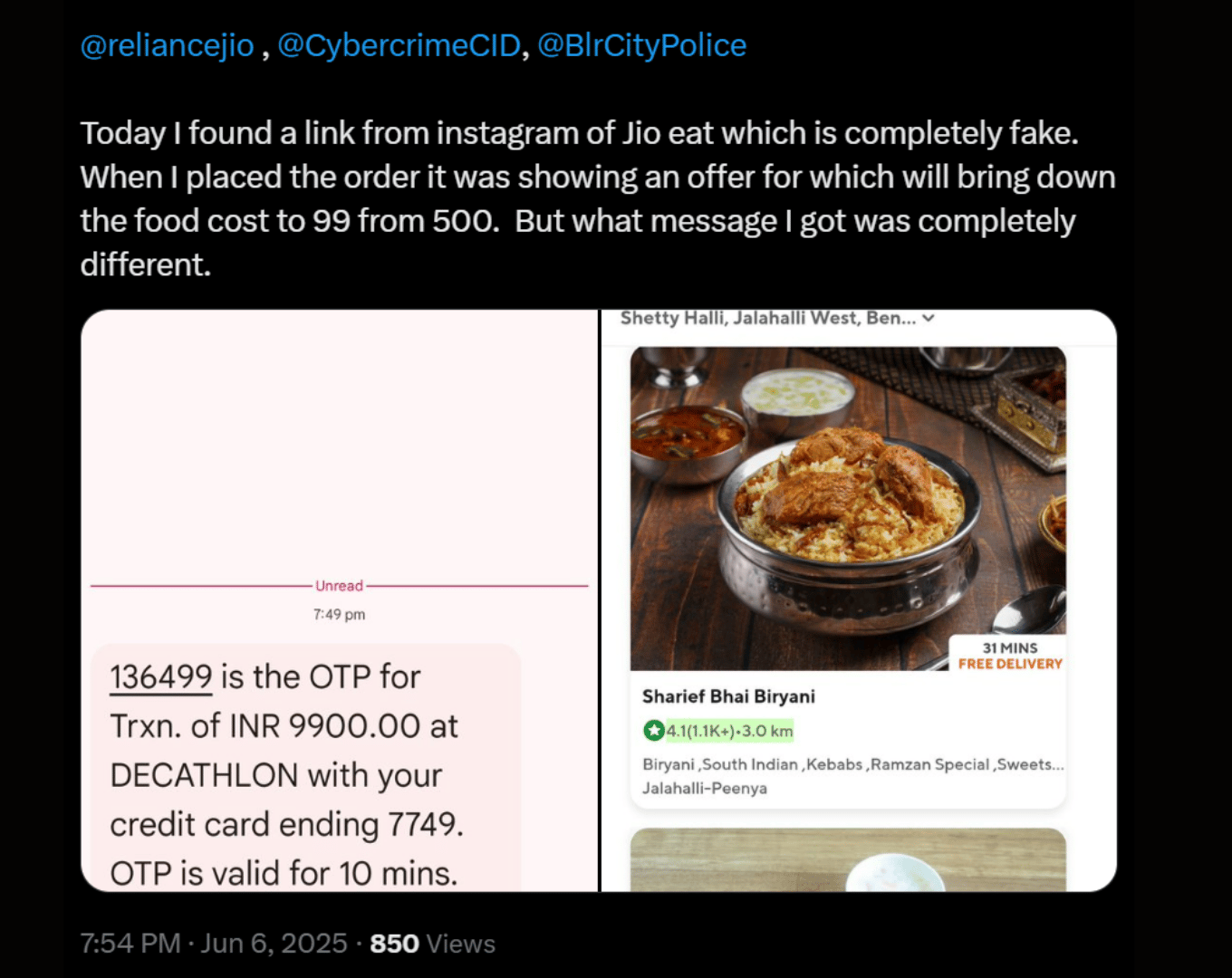

While dishes are priced as per a standard menu, the website sends an order confirmation OTP for an altogether different and significantly higher amount.

When we at Inc42 tried to place an order for INR 130, the OTP was received for a transaction worth INR 16,119 billed by an entity named “CSC E GOVER”.

An unsuspecting user might not look at the amount in the SMS, and end up providing the OTP to complete the order. And by the time they realise the mistake, it is often too late.

Notably, the fraudsters have been promoting the fake Jio Eat platform through YouTube.

The platform seems to be live for about 10 days now and there are a number of complaints by users on social media platforms like X, LinkedIn and Reddit about it.

“@JioCare A big scam has been operational in name of #Jioeat, where the site shows lucrative offers via @YouTube ads, and payment of INR 99 through fake @Razorpay site sends OTP of INR 30099. One can find other similar cases on X,” a user posted on X a couple of days ago.

Inc42 has sent a detailed questionnaire to Reliance Retail on the fake platform and the steps the company has taken or plans to take against it. The story will be updated on receiving a response from the company.

Inc42 has sent a detailed questionnaire to Reliance Retail on the fake platform and the steps the company has taken or plans to take against it. The story will be updated on receiving a response.

Rising Competition In Food DeliveryBesides the sophistication of this scam, it is critical to highlight that this comes at a time when India’s food delivery ecosystem is seeing rapid changes.

While food delivery has been dominated by the duopoly of Swiggy and Zomato so far, Rapido is entering the space to challenge them. per order, which can be as low as INR 10 or INR 25 depending on the order value.

Notably, large corporate houses have stayed away from the food delivery space so far. Reliance Retail never had plans to foray into the space.

The development also comes at a time when the number of digital frauds are on the rise in the country. The country saw 2.4 Mn incidents of digital fraud amounting to INR 4,245 Cr in the first 10 months of FY25, according to finance ministry’s data.

To curb the growing digital frauds, RBI governor Sanjay Malhotra, in January, urged financial institutions to enhance oversight over their third-party service providers for mitigation of the risks related to information technology (IT) and cyber security.

The post appeared first on .

You may also like

Israel-Iran conflict: Emirates, Etihad, and UAE airlines extend flight suspensions, key info for travellers

Nagastra-1R suicide drone: Check the features of this made in India drone

Dad screams as he's dragged to his death by crocodile after ignoring warning signs

BSEB Super 50: Bihar Board is giving second chance for free coaching for JEE and NEET, apply from today; know details..a

Sangli Horror: Father Kills Class 12 Daughter With Stone Grinder Handle Over Poor Test Performance