There was a common refrain in Indian fintech a few years ago: “As a fintech startup, you eventually pivot to lending because that is how one makes money.” All that has changed now.

Startups enabling billions of digital transactions (UPI) were not earning much from payments, due to zero MDR (merchant discount rate) imposed on UPI transactions of all ticket sizes. Lending was the first answer, but now, after many years, Indian fintech startups are looking at stock broking to break out of the revenue hole.

Building a lending layer on top of the existing mammoth UPI user base made sense around 2019 and 2020, especially when demand for personal and small business loans was high. The Reserve Bank allowed banks and NBFCs to lend through UPI super apps, but the lending boom led to lending malpractices and unscrupulous players.

Soon, every app was a lending app. But the RBI cracked down on the wanton digital lending and credit disbursement, leading to troubles across the fintech ecosystem.

First, it came for credit card companies in 2021 and 2022, many of which had to pivot, and then the BNPL crowd, which was more or less pushed out by regulations around the same time.

In late 2022, there was a mandate on RBI-registered banks and NBFCs to increase the risk weights for digital unsecured loans, and finally, the first loss default guarantee (FLDG) guidelines, which made it expensive for lending apps to operate.

These changes and a slight slowdown in the frenzied loan demand post the pandemic have resulted in a chill in the digital lending space.

Suddenly, apps and platforms that had indexed for lending operations, added new risk and underwriting models were left with no real revenue advantage. Everyone is more or less operating as a loan distributor today when it comes to the lending, And in the meanwhile UPI has not really changed into a revenue generation product. So what are fintech companies turning to next?

The answer is stock broking. Everyone wants to be the next Zerodha and Groww.

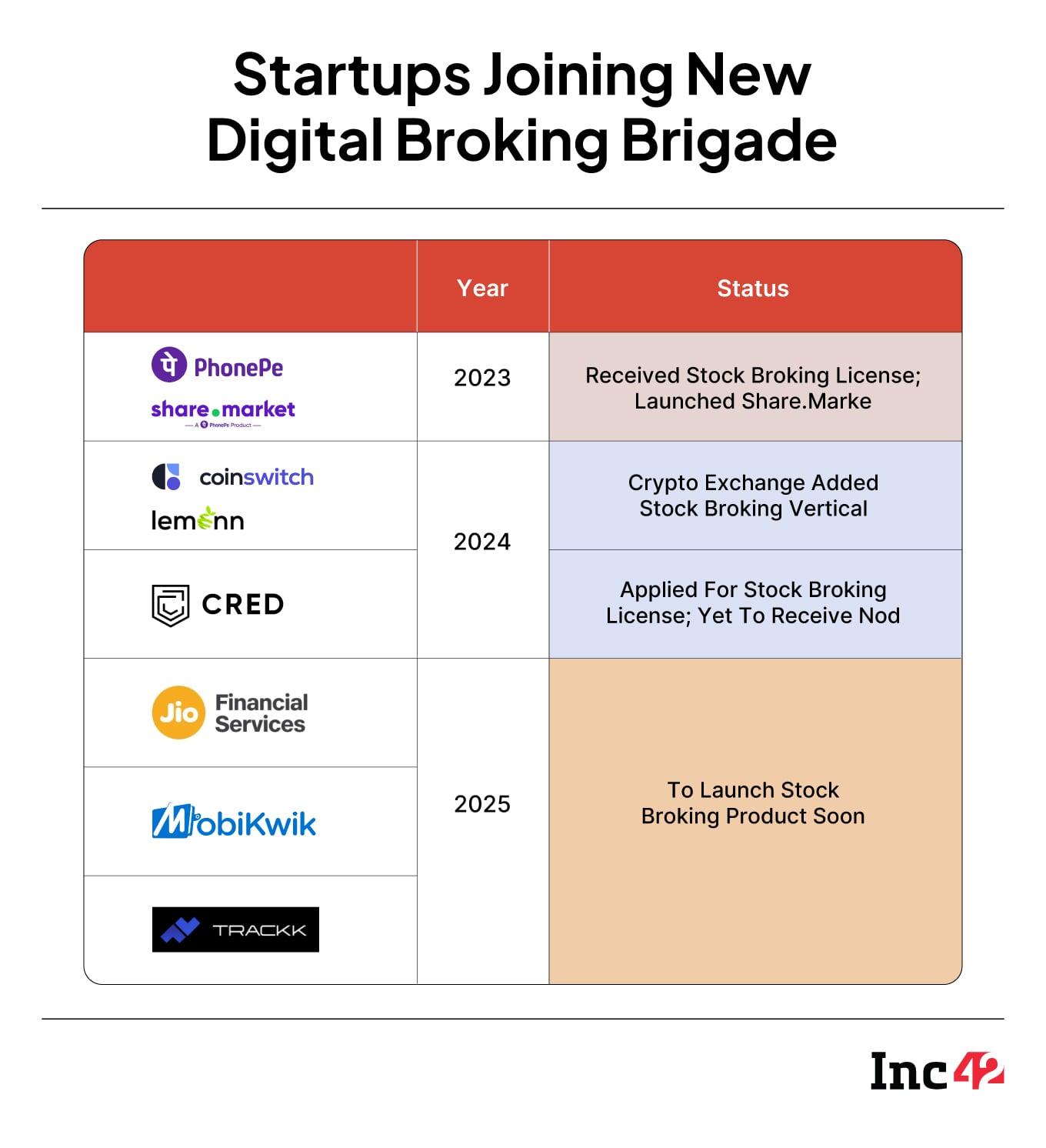

Fintech Giants Flock To Stock BrokingThe likes of Jio FInancial Services (JFS), MobiKwik and others have recently bagged approvals to operate their own digital discount broking platforms. It’s a heavily crowded field that also includes Paytm Money, PhonePe’s Share.market, AngelOne, Upstox, Coinswitch-owned Lemonn, INDMoney and others. Kunal Shah-led Cred has also applied to operate as a stock broker via Spenny which it acquired in 2023.

Does it make sense to join this heavy competition especially when the Indian equities market is going through a bit of a slowdown?

The newfound obsession for stock broking licenses, according to a VC who invests in early-stage fintech companies, is reminiscent of how the fintechs would rush for NBFC licenses during the prime lending days.

However unlike lending, equity markets according to the industry experts we spoke to present a much predictable monetisation opportunity with a stickier userbase, a large underpenetrated market and not many cost overheads.

Bipin Preet Singh, CEO of Mobikwik, said in a statement that as a new broking platform, it will try to attract new investors that join the market every year.

“India has witnessed incredible growth in retail investor participation, and we believe our platform can help demystify investing for users taking their first steps into the markets. With this, we move a step closer to our goal of building a full-stack fintech platform that eases the adoption of digital financial services for the untapped populace of Bharat,” Singh said.

The listed fintech company is a good example of how companies are shifting focus from unsecured lending to stockbroking. Mobikwik’s share of revenues from financial services (unsecured loans) fell by 28% in FY25 to INR 402 Cr compared to INR 558 Cr in FY24.

Similarly, Paytm reported a 19% QoQ drop in its unsecured loans disbursal Q4 FY25 to INR 1,422 Cr.

Notably, India’s equity market penetration stands at 3% for the active user base, much less than the developed economies despite a pandemic-fuelled boom in retail investments by younger Indians. It is this boom that Groww cashed in on to become the platform with the most active investors, outpacing Zerodha and others.

Sonam Srivastava, founder of Wright Research, a SEBI-registered wealth advisory startup, told Inc42 that fintech startups will also have to compete with banks like HDFC Bank, Kotak Mahindra Bank that have launched their own dedicated platforms to attract the young retail investors

“On the other hand we have seen market consolidation especially in the discount broking model with the likes of Zerodha, Groww, Angel One dominating the industry for the past several years with their proven business models and becoming profitable,” she added.

Industry experts say that for any large fintech to succeed in the wealthtech vertical, the infrastructure play will be hugely critical, which includes everything from security to information access to customer experience on the app side.

“Unlike lending, where the collection and defaults weigh heavily on the company’s balance sheets, stock broking offers safer monetisation avenues like brokerage fees, margin trading, advisory services, loans against securities and portfolio management. These are relatively operationally inexpensive too,” the fintech investor quoted above said.

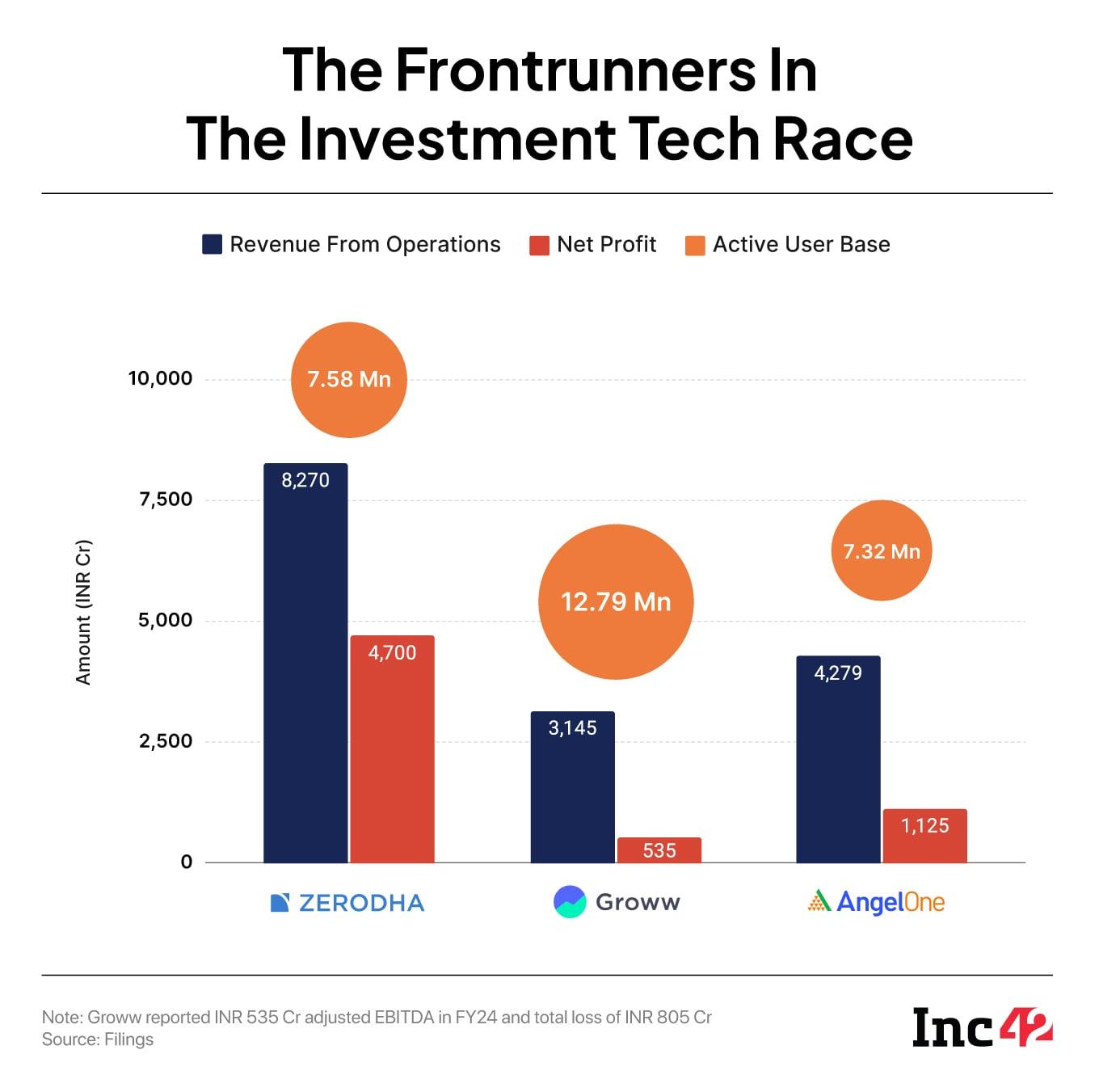

Startups Eye Stock Broking Revenue BumpSpeaking of revenue, this is also a major compelling force driving the new wave of stock broking apps. Zerodha and Groww have set the profitability benchmark, and even though the latter slipped into losses last year due to a heavy redomicile tax burden, it is still in a better position than most other fintech apps.

Zerodha’s consolidatedrevenue jumped 37.16% to INR 9,372.1 Cr in the financial year ending March 2024 (FY24) from INR 6,832.8 Cr in the previous fiscal. Its net profit surged 88.95% to INR 5,496.3 Cr during the year under review from INR 2,908.9 Cr in FY23.

IPO bound Groww ‘s revenues more than doubled to INR 3,145 Cr with operational profitability of INR 535 Cr despite paying INR 1,340 Cr in taxes for reverse flipping from the US to India.

As of June 2025, Groww commanded a 26.27% share in the active user base in equity markets followed by Zerodha whose share stood at 15.5%, according to NSE data.

But this was last year.

Since October 2024, there has been a user decline in this space. In the first half of 2025, both Groww and Zerodha lost 11 Lakh active investors which was around 5% of the total active user base. The decline was seen across the top 10 discount broking and traditional stock broking firms, so it’s not a matter of platforms losing investors to major competition.

Wright Research’s Srivasatava attributed this downfall to the way markets have reacted in the last one year amidst volatile macroeconomic conditions and fatigue. “Equity markets will have such churns for a year or so before they gain momentum again. Plus we see markets saturated from investors’ standpoint amidst SEBI also tightening its norms around F&O trading which has particularly dissuaded investors who are investing for quick bucks,” Srivastava said.

Analysts believe that the number of passive investors investing in SIPs has also seen a decline. Seen as the most resilient asset class, even in the volatile market conditions, SIP inflows have seen a continual decline since last year and a lot of capital flight.

Analysts have however termed these headwinds as cyclical which will impact Zerodha, Groww’s userbase or profits in the short term, however as the markets recover, the discount brokers are expected to be back on track again.

In the face of muted user growth in the equity markets, does it make sense for the new entrants to jump on the bandwagon? And more importantly, what will it take to dislodge the majors?

Room For Disrupting Zerodha, Groww?What Zerodha and Groww had on their side was timing. The pandemic-induced boom lifted both companies and it allowed them to dedicate their energy into improving their tech stack, marketing strategies and educational tools.

We have spoken about both companies struggling with downtime, tech and security challenges in the past as both their user bases exploded.

“Wealththtech is not operationally cost intensive and really needs seamless user experience for investors, a significant percentage among whom may be using that particular broking app several times a day. Zerodha and Groww have improved significantly on these fronts and have now customised tools for both serious traders and passive investors,” according to the founder of a wealthtech startup in Bengaluru.

Can rivals counter with the same to loosen Zerodha’s grip as a first mover and slow down Groww’s marketing machine? According to those we spoke to, a key strategy will be to eat away at the market share of the top players through engagement measures, superior technology and aggressive pricing.

The last one is a page from Groww’s playbook which relied on zero charges to bring in new Demat accounts and investors.

This could be something that Jio Financial Services banks on to convert many new-to-the-market investors from Reliance Jio’s 500 Mn telecom subscriber base. Similarly PhonePe’s Share.Market platform has the user base to capitalise and compete with Zerodha and Groww.

Launched in August 2023, Share.Market claims to be leveraging AI, analytics, research-based tools to help investors make data-driven investing decisions.

But what about the other newer players who may not have a clear hook for selling.

MobiKwik’s foray into stock broking, combined with its existing payments ecosystem, is likely to result in a bundled model to ensure user sickness, according to those we spoke to.

Flipkart backed Super.money seems to be another likely entrant into stock broking segment with its founder last month hinted at the company’s efforts to build a user-centric trading platform which shouldn’t be built “just for experts”.

Anirudh Garg, partner at INVasset PMS, a SEBI-registered AI and quant Investing advisory, told Inc42 that the immediate risk to incumbents wouldn’t be from a massive user decline but shrinking engagement. New players will fragment user attention and offer bundled services across broking, lending, and payments, which could shake Zerodha and Groww. While Groww has some overlap into payments, this is not a core focus for the company.

“The timing intensifies the pressure: SEBI’s curbs on retail F&O participation—where new age brokers derive a bulk of their revenues—are tightening margins across the board. While these platforms built scale on frictionless UI and zero-commission trades, their stickiness faces a new test,” Garg added.

The threat for Zerodha and Groww is that new-age fintech startups might just see an insight that goes beyond enabling trades. The user experience and embedded wealth products could dictate the course of the competition.

“As Zerodha’s Nithin Kamath rightly notes, “deep pockets don’t equal deep moats.” Broking is a trust game, not a capital one. The real erosion risk lies in failing to adapt to a post-derivatives world—where long-term investing, advisory services, and experience-led loyalty will matter more than raw trading volume. The challenge is less about user loss and more about relevance in a reshaped revenue model. For older platforms, evolution—not just scale—will be the key differentiator,” the INVasset partner added.

Playing The Long GameSrivastava believes that JFS, MobiKwik and other newer players are eyeing the long-term opportunity in the next 3-4 years. For instance, she believes, a typical Jio 4G subscriber may not be ready for equity markets yet, so the retail investment penetration still remains low.

The long-term opportunity remains, and the number of new players has created a new battle in fintech.

While lending has turned out to be a regulatory headache, stock broking and investment tech offers a sustainable revenue alternative with a high growth ceiling. Garg explained only around 10 Cr (100 Mn) Indians are actively participating in markets which is just about 7% of the population. “India’s runway for retail equity participation is immense. The broader implication is strategic. As regulatory constraints cool down the F&O mania, stock broking will evolve from transaction-driven margins to lifetime value models,” he claimed.

He also believes that differentiation will emerge from ecosystem integration, trust, and embedded advisory.

Zerodha and Groww have enjoyed the luxury of relatively little competition for a number of years. How they react to this new competition will be just as intriguing from the perspective of not just investors but India’s fintech ecosystem too.

[Edited By Nikhil Subramaniam]

The post The Race To Be The Next Zerodha: Why Fintech Startups Are Rushing Towards Stock Broking appeared first on Inc42 Media.

You may also like

For one week only shoppers can save 50% on 'sophisticated and sensual' Rabanne perfume

SC certificates obtained through conversion will be cancelled: Fadnavis

Madras HC issues notice to actor-turned-politician Vijay, TVK over flag design copyright suit

Women of West Bengal want PM Modi to address their safety ahead of his visit

Sidharth Malhotra requests privacy from media after video of him getting angry on paparazzi on social media