Global markets are on a roller coaster, investors are clueless, and the Indian startup ecosystem is nothing but a silent spectator to what is yet to come. At the centre of this is , which has the potential to set off a pandemic-like crisis, minus the disease.

Although the US has given a 90-day relaxation, temporarily deferring tariff hikes for many countries, including India, the horizon still appears clouded due to the uncertainty ahead. But, what does it mean for VCs?

Fear Of A Covid-Like Crisis Ahead? VCs are reassessing timelines and exit strategies, while foreign limited partners are delaying capital deployment. The concern? Much like the Covid-19-triggered chip shortage, Trump’s tariff war could cause long-term disruptions in global supply chains.

The Wait & Watch Strategy: While Indian startup investors seem to be groping in the dark to understand the impact of the US’ tariff decision on the country, foreign LPs are sitting on the fence and conserving their funds for now as more clarity emerges.

Why Are VCs Concerned? The unpredictable tariff disputes have disrupted long-term investor forecasts, compelling VCs to reassess how they revalue their portfolio companies, particularly during the remainder of Trump’s presidency.

Any Silver Lining? Notwithstanding the fears of another capital drought, investors see tariff wars as a chance for India’s deeptech manufacturing and exports to grow. With sectors like defence tech, semiconductor, and spacetech in focus, VCs expect US investment in Indian startups to continue in a more calibrated manner in the long term.

Even though VCs see India in a more advantageous position compared to China and other countries, much could change “forever” in a matter of two quarters. As uncertainties loom large, .

From The Editor’s Desk: CEO Gaurav Munjal has claimed that 70% of the edtech startup’s offline centres are on track to turn profitable this year. He claimed that Unacademy will reduce cash burn by nearly 50% YoY to under INR 200 Cr in 2025.

: The proptech startup is in advanced discussions to raise about $11.7 Mn in funding from a large unnamed VC fund and existing investor Chiratae Ventures. Founded in 2021, HouseEazy operates a marketplace for reselling houses.

: The Tiger Global-backed house of brands startup, which was formerly called Mensa Brands, is raising INR 48 Cr debt from Stride Ventures. This comes at a time when BRND.ME is in the process of shifting its base to India.

: The fintech giant’s ecommerce platform, Pincode, has rolled out a 10-minute medicine delivery service in Bengaluru, Pune and Mumbai. This follows Pincode piloting its quick commerce service in six cities last year.

The competition watchdog has ruled that platform fees and delivery charges levied by the foodtech major do not amount to unfair conduct. The case pertains to a plea that alleged that Zomato indulged in anti-competitive practices.

: The big tech major has agreed to pay INR 20.24 Cr to settle an antitrust case in the smart TV segment. Google also agreed to provide a standalone licence for Play Store and Play Services for Android smart TVs in India.

: The South Korean gaming major has selected six gaming studios across the country for the second cohort of its incubation initiative. KRAFTON will offer $150K in grants and mentorship to selected startups.

: Amid the ongoing tariff wars, the Centre plans to cap Chinese investments in electronics joint ventures at 10%, contingent on technology transfer, prioritising local manufacturing development.

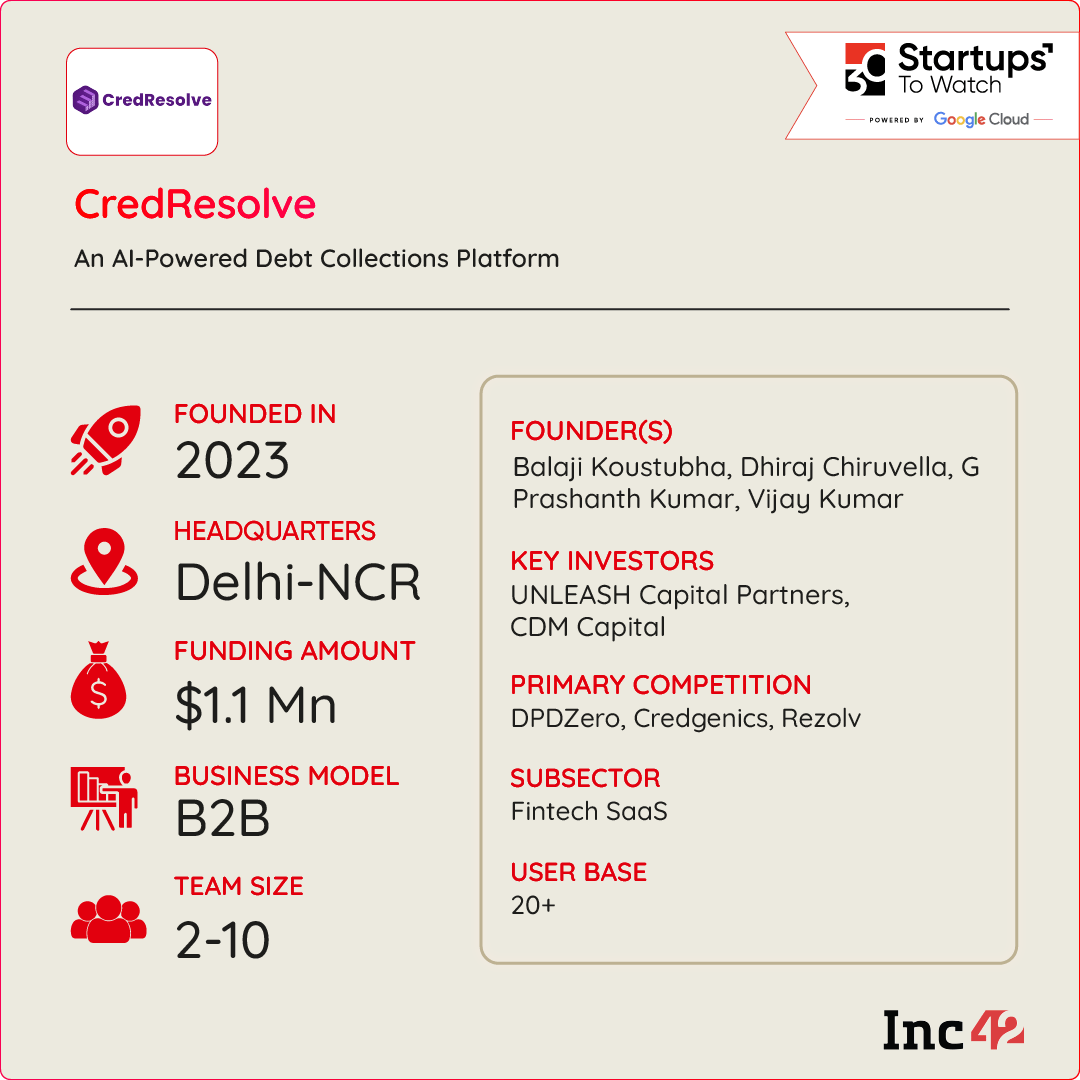

Inc42 Startup Spotlight How CredResolve Is Using AI For Debt ResolutionHigh delinquency rates, even for small ticket size loans, have been a major pain point for India’s NBFCs. Looking to solve this is Bengaluru-based CredResolve with its GenAI playbook.

Tackling Defaults With AI: Founded in 2023 by Balaji Koustubha, G Prashant Kumar, and Vijay Kumar, CredResolve becomes a mediator between the borrower and the lender and helps in streamlining the debt resolution process.

The startup uses its AI-powered systems to assign credit scores to borrowers based on their ability to repay. Further, it sends automated digital legal notices to defaulters and manages the online litigation process. Besides, it also creates daily planners for loan collection agents and provides workflows for digital communication.

The Burgeoning Opportunity: Working with the likes of major financial players like IDFC First Bank, L&T Finance, MobiKwik, and Lendingkart, CredResolve is looking to make a dent in the Indian lending tech market, which is estimated to become a $1.Tn opportunity by 2025-end.

With competitors sharpening their claws,

The post appeared first on .

You may also like

He did not come to Goa, but Pope Francis touched hearts here

Nimrat Kaur witnesses magical Buransh flower blossoms in Kumaon for the first time on World Earth Day

'Didn't Get The Start We Wanted And Faltered In The End', Bravo Admits After KKR's Loss To GT

US Vice President J D Vance, family visit Jaipur's Amber Fort

White House planning to replace Pete Hegseth as Pentagon chief: Report