Mumbai: State Bank of India expects corporate credit growth to accelerate in the coming quarters, supported by a Rs 7 lakh crore pipeline of loans. Chairman CS Setty said the bank anticipates at least 10% growth in corporate lending over the next two quarters, even as corporates continue to make large pre-payments.

Setty said repayments in the second quarter were driven by equity issuances and IPOs, with some corporates using funds to repay loans or refinance through bonds. "A couple of airports were like that," he said, adding that some govt entities also made large repayments after receiving funds upfront. The chairman answered analyst queries in a post-results meeting.

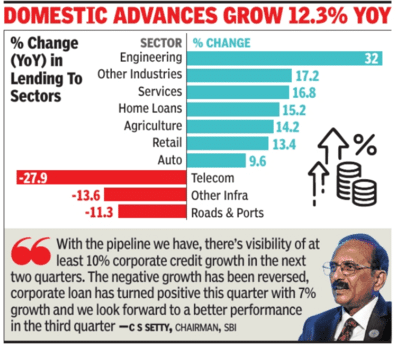

The bank's domestic advances grew 12.3% y-o-y to Rs 37.4 lakh crore as of Sept 30, 2025. Following RBI's recent monetary policy and reforms, SBI has raised its credit growth target to 12-14%.

Lending to infrastructure sectors fell 3%, reflecting steep declines in constituent sectors telecommunications (-27.9%), roads and ports (-11.3%), and other infrastructure (-13.6%). Credit to tourism and hotels also dropped 14.3%. However, lending to engineering surged 32%, while other industries grew 17.2%, services 16.8%, and home loans 15.2%. Auto, retail, and agriculture loans rose 9.6%, 13.4%, and 14.2%, respectively.

Setty said the Rs 7 lakh crore corporate loan pipeline has stayed steady across quarters, with half already sanctioned and awaiting disbursement. "The remaining half is in discussions," he said. "This includes both working capital lines and term loans. The new projects are largely from the private sector, though some are from the public sector." He said part of the pipeline would materialise this year, with some spillover into the next year.

On the new guidelines allowing funding of mergers and acquisitions, Setty commented that the bank has been funding cross-border acquisitions and might also look at collaborating with foreign banks.

"Working capital utilisation has risen, signaling recovery in consumption demand. The corporate bond shift is cyclical. We expect sustained double-digit system-wide growth," said Setty. He added that there was a sharp pick up in auto loans after the GST cut which came into effect only in Sept 22.

"With the pipeline we have, there's visibility of at least 10% corporate credit growth in the next two quarters," Setty said. "The negative growth has been reversed, corporate loan has turned positive this quarter with 7% growth and we look forward to a better performance in the third quarter."

Retail credit remains a key growth driver. "Home loans at 15% is good growth," Setty said. "We have a large catchment, and customer acquisition is robust," he said, adding that the home loan portfolio should stabilise at 14-15% growth.

The bank is also emphasising express credit-its unsecured personal loan product. Setty said demand for express credit had been affected as borrowers moved to gold loans, attracted by higher ticket sizes and lower rates. "As gold prices moderate, we hope express credit will grow," he said. "Our sanctions and disbursements have been significant-it's a high-churning product that requires continuous customer acquisition."

Setty said repayments in the second quarter were driven by equity issuances and IPOs, with some corporates using funds to repay loans or refinance through bonds. "A couple of airports were like that," he said, adding that some govt entities also made large repayments after receiving funds upfront. The chairman answered analyst queries in a post-results meeting.

The bank's domestic advances grew 12.3% y-o-y to Rs 37.4 lakh crore as of Sept 30, 2025. Following RBI's recent monetary policy and reforms, SBI has raised its credit growth target to 12-14%.

Lending to infrastructure sectors fell 3%, reflecting steep declines in constituent sectors telecommunications (-27.9%), roads and ports (-11.3%), and other infrastructure (-13.6%). Credit to tourism and hotels also dropped 14.3%. However, lending to engineering surged 32%, while other industries grew 17.2%, services 16.8%, and home loans 15.2%. Auto, retail, and agriculture loans rose 9.6%, 13.4%, and 14.2%, respectively.

Setty said the Rs 7 lakh crore corporate loan pipeline has stayed steady across quarters, with half already sanctioned and awaiting disbursement. "The remaining half is in discussions," he said. "This includes both working capital lines and term loans. The new projects are largely from the private sector, though some are from the public sector." He said part of the pipeline would materialise this year, with some spillover into the next year.

On the new guidelines allowing funding of mergers and acquisitions, Setty commented that the bank has been funding cross-border acquisitions and might also look at collaborating with foreign banks.

"Working capital utilisation has risen, signaling recovery in consumption demand. The corporate bond shift is cyclical. We expect sustained double-digit system-wide growth," said Setty. He added that there was a sharp pick up in auto loans after the GST cut which came into effect only in Sept 22.

"With the pipeline we have, there's visibility of at least 10% corporate credit growth in the next two quarters," Setty said. "The negative growth has been reversed, corporate loan has turned positive this quarter with 7% growth and we look forward to a better performance in the third quarter."

Retail credit remains a key growth driver. "Home loans at 15% is good growth," Setty said. "We have a large catchment, and customer acquisition is robust," he said, adding that the home loan portfolio should stabilise at 14-15% growth.

The bank is also emphasising express credit-its unsecured personal loan product. Setty said demand for express credit had been affected as borrowers moved to gold loans, attracted by higher ticket sizes and lower rates. "As gold prices moderate, we hope express credit will grow," he said. "Our sanctions and disbursements have been significant-it's a high-churning product that requires continuous customer acquisition."

You may also like

Average online side hustle earns Brits over £5k a year - with Millennials making the most

Vibrant aquatic and reptile life thrives along and beneath iconic grasslands of Assam's Kaziranga National Park

From Maruti Suzuki Celerio to Tata Punch: Here are the top mileage cars under Rs 10 lakh!

Farah Khan reveals she walked barefoot to Haji Ali to marry the man she loved, thanks God for not answering her prayers

M1 traffic LIVE: Chaos on major motorway as crash sparks 50-minute delays